It’s not an easy time for global trade–the roughly $25 trillion piece of the $105 trillion world economy. Protectionism is roaring in the U.S. and Europe, causing geopolitical tension with China. Inflation across most of the world has shrunk consumers’ wallets and imports, while deflation in China is also scaring businesses. Asian supply chains are slumping. After Russia’s invasion of Ukraine in 2022, the late 2023 conflict in Israel-Palestine has created more business uncertainty, danger for container ships transiting the Red Sea, and geopolitical tension. And then there’s the structural shifts in supply chains that have raised fears of deglobalization. That is probably less of a risk that people think. “We do see some signs in the data of trade fragmentation linked to geopolitical tensions,” said WTO chief economist Ralph Ossa. “Fortunately, broader deglobalization is not here yet. The data suggest that goods continue to be produced through complex supply chains, but that the extent of these chains may have plateaued, at least in the short run.” In other words, this is a time of change, more reason than ever to pay close attention to trends.

Here are Trade Data Monitor’s top 10 ongoing trade trends at the start of 2024:

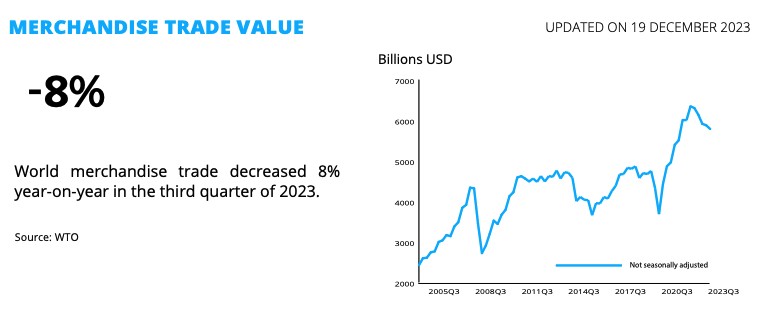

- Trade Crisis: Protectionism, price swings (inflation in the U.S. and Europe, deflation in China) and geopolitical tensions have created an uncertain environment for trade. The World Trade Organization now forecasts global trade to grow by only 0.8% in 2023, less than half the 1.7% increase predicted in April. For 2024, the WTO expects an increase of 3.3%, a modest recovery, but below the trend in the early 2000s.

- The COVID Effect: The COVID-19 pandemic depressed trade in 2020-2023, but now it’s triggered a booming in shipments of vaccines and medical test kits. The U.S. increased imports of medical test kits 46% to $44.7 billion in the 10 months of 2023. The top exporters of medical test kids are Switzerland (up 12% to $39.3 billion), Germany (up 9% to $24.5 billion), and the U.S. (up 11% to $16 billion), followed by Ireland, Belgium and the Netherlands.

- China Problem: It used to be that you could count on death, taxes and an uptick in Chinese exports. That’s no longer the case. Manufacturers have diversified their supply chains, consumers aren’t buying enough, and tariffs and export restrictions are rising. The upshot: In the first 11 months of 2023, Chinese exports declined 4% to $3.1 trillion. Exports to the U.S. over that time fell 13% to $463.7 billion.

- Asia’s Slump: China wasn’t the only Asian country to suffer declining exports. Singapore’s shipments fell 9.3% to $395.5 billion, South Korean exports declined 10% to $519.3 billion, and Japan’s sales fell 4.6% to $591.4 billion, and Taiwan’s exports fell 12.6% to $354.2 billion in the first 10 months of 2023.

- U.S. and European Rebound: The situation has been better for the U.S. and Europe. Supply chains are adjusting away from China, benefitting U.S. and European trade. Germany’s exports rose 1.5% to $1.4 trillion and French shipments increased 5.3% to $527.9 billion in the first 10 months of 2023. U.S exports declined 2.4% overall to $1.7 trillion, but that was mainly because of a decline in fuel prices. Shipments of electronics, machinery, cars, airplanes and pharmaceuticals all increased.

- Don’t Take Your Eye Off Electric Cars: Electric cars might be the most significant trade product in the world right now. Germany (up 86% in the first nine months of 2023 to $30.4 billion), China (up 112% to $25.1 billion), Belgium (up 78.1% to $13.3 billion), South Korea (up 89% to $10.4 billion) and the U.S. (up 41.4% to $5.8 billion) are leading the charge.

- The Energy Revolution: Investments in green energy, driven by governments and consumer demand, are propelling new trade flows. For example, U.S. imports of solar panels and related parts increased 70.1% to $19.5 billion in the first 10 months of 2023.

- Russia-China Trade: The huge boom in Russia-China trade, triggered by the war in Ukraine and subsequent U.S. and European sanctions, is still going on but it is finally showing signs of tapering off. Russia is now China’s sixth biggest source of imports and sixth biggest export destination. But after triple-digit increases in 2022, monthly increases are finally dropping. For example, in November 2023, Chinese exports to Russia increased 35% to $10.3 billion.

- Regional Trade Boom: We’re seeing a healthy boom in regional trade networks. One example is the Middle East. For example, Iranian exports to Iraq (+73%) and Turkey (+32%) increased but the country’s shipments to China fell 16.3% in the first nine month of 2023. And the increases weren’t only driven by higher oil prices. Iran increased its oil exports to Iraq 332.8% to 88.4 million barrels in the first nine months of 2023.

- China is Buying All the Coal: While much of the rest of the world is trying to wean itself from fossil fuels, especially the dirtiest one, coal, China is ramping up imports. Ironically, it needs coal partly to power a new generation of power plants pumping out electricity for electric car batteries. In the first 10 months of 2023, it hiked purchases of the black rock 38% to $33.5 billion by value, and 96.6% by quantity to 250.3 million tons.

John W. Miller is Trade Data Monitor’s Chief Economic Analyst, in charge of writing TDM Insights, a newsletter analyzing key issues through trade statistics. John is an award-winning journalist who’s reported from 45 countries for the Wall Street Journal, Time Magazine, and NPR.