Higher prices for rare-earth minerals and strategic support from the U.S. and other governments have sparked further investment, production, and international trade, diversifying supply for minerals that are essential to high-tech production.

Rare earths elements, such as dysprosium, lanthanum and cerium, are 17 elements used as niche ingredients in magnets, batteries and catalytic converters.

These elements, sometimes known as REE, are abundant in the earth’s crust. In 2018 there were 3,114 known deposits located in 107 different countries, according to the U.S. Geological Survey.

While deposits are plentiful, ores with high concentration of rare earths are not. Unlike readily recoverable elements such as copper and zinc, recovery of rare earths from ore is expensive and complex. Byproducts can be toxic and even radioactive. This means that mines often sit dormant until prices spike or governments intervene with subsidies, and justify investing in extracting the minerals.

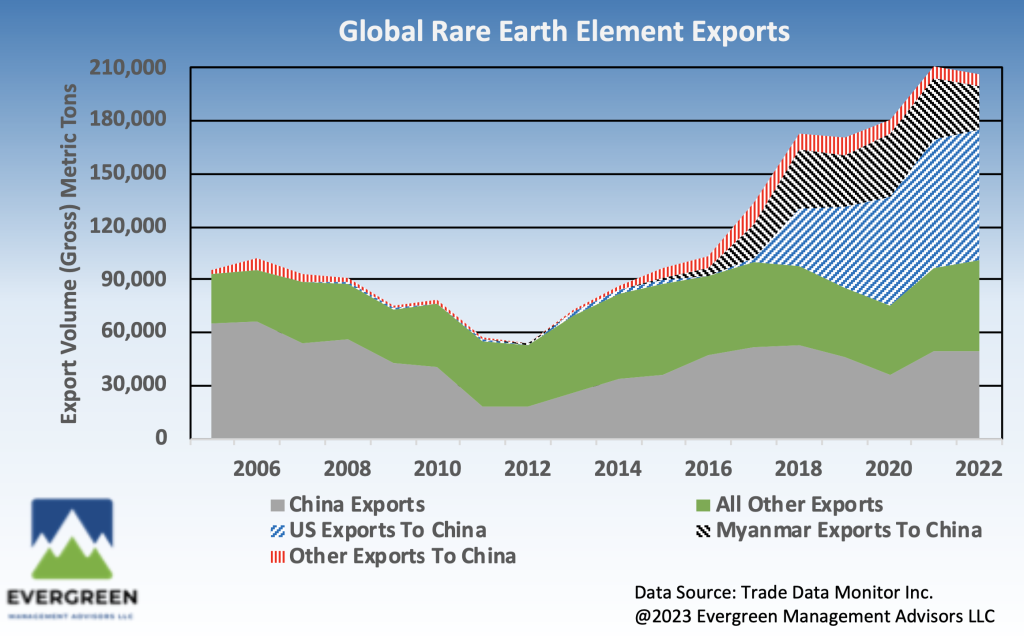

China is recognized as the global rare earth oxide, sometimes known as REO, separation, alloying and metal making leader, processing domestic ores, import ores and concentrates primarily from the U.S. and Myanmar.

Our graph below shows a significant increase in U.S. concentrate exports to China starting in 2017 when the Mountain Pass Mine in California, the dominant U.S. source, was restarted and shipments of concentrates started to be sent to China for further processing.

Long term, the U.S. will need to establish domestic REO separation and alloying and metal making capabilities rather than rely upon import sources.

MP Materials, Lynas, and Energy Fuels have begun investing in the U.S. In the next decade, their investments should result in more stable pricing and reduce supply chain vulnerability.

By Dan Durbin, Evergreen Management Advisors LLC, and John W. Miller, Trade Data Monitor