The focus of the global trade world is, rightly, on President-elect Donald Trump and his incoming U.S. administration debating and deciding how far Washington will go in enacting new import tariffs and sanctions. How high will the tariff wall go? Will the USMCA be renegotiated? Which industries will be exempted from the new protectionism? There are a lot of outstanding questions to be answered. But the world is bigger than the U.S. or any particular sector. There are, for instance, around 5,300 different codes in the harmonized tariff code system overseen by the Brussels-based World Customs Organization. In the mountain of import and export statistics catalogued by Trade Data Monitor, here are ten trends to watch for 2025:

1. Globalization Is Not Dead: The scale of global trade is such that, even if government adopts protectionist measures en masse, it’s unlikely to collapse. Total exports in 2024 are expected to be around $25 trillion. The logistics sector along is worth over $10 trillion. Global trade isn’t going anywhere. In October, the WTO said total trade in goods should increase by 2.7% in 2025, and by a few more percentage points if conflict in the Middle East is contained. In the first 10 months of 2024, the U.S., the world’s top import market, ramped up imports 5% to $2.7 trillion.

2. American Pie: As the world’s top consumer market, the U.S. has leverage in controlling access to its markets, and its outsourcing manufactures should easily find countries able to replace China and other targets for tariffs on more favorable terms. America’s top source of imports is now Mexico, followed by China and Canada. President Trump has threatened to impose hefty tariffs on all three countries. The next biggest exporters to the U.S. are Germany, Japan, South Korea, Vietnam, Taiwan, Ireland, and India. Ireland is an interesting case. It’s the U.S.’s top supplier of pharmaceuticals, shipping in $42.8 billion worth in the first 10 months of 2024. It’s hard to imagine Washington slapping tariffs on a product as politically sensitive as pharmaceuticals. In other words, there’ll still be pie to go around.

3. China Buying: An issue that could upend geopolitics — with unintended consequences that will affect big issues like war and peace, migration, and supply chains — just as much is what appears to be a crumbling in Chinese domestic demand. In a time of geopolitical shifting and adjustments, it’s one of the key factors to watch. In the first six months of 2024, according to TDM, China was the world’s second largest importer, shipping in $1.3 trillion worth of goods, behind only the U.S. at $1.6 trillion, and followed by Germany, the Netherlands, and the UK. (France, Japan, India, South Korea and Italy round out the top ten.) In November, total Chinese imports fell 3.9% to $214.9 billion from $223.6 billion a year ago. Almost certainly knowing these numbers were coming, Beijing on Monday said it would unroll an “appropriately loose” monetary policy in 2025.

4. Rich Asian Markets: Luckily, many of China’s neighbors have been on a newfound path to prosperity. The dream of an open and inviting Chinese market for Western businesses might have withered, but an overlooked sector of the global economy that cumulatively is just as impressive is other rich Asian markets. They’ve also benefited from globalization to expand their middle classes. Many of the fastest-growing import markets in the world are in Asia. Take Malaysia. In the first ten months of 2024, Malaysia increased imports 13.2% to $248.5 billion. Or Thailand, where imports increased 6.7% to $259.6 billion. And most of their trading partners are also in Asia. That’s why the WTO expects Asian export volumes to increase by as much as 7.4% in 2024. In Europe, by contrast, exports are expected to contract 1.4%., the WTO said.

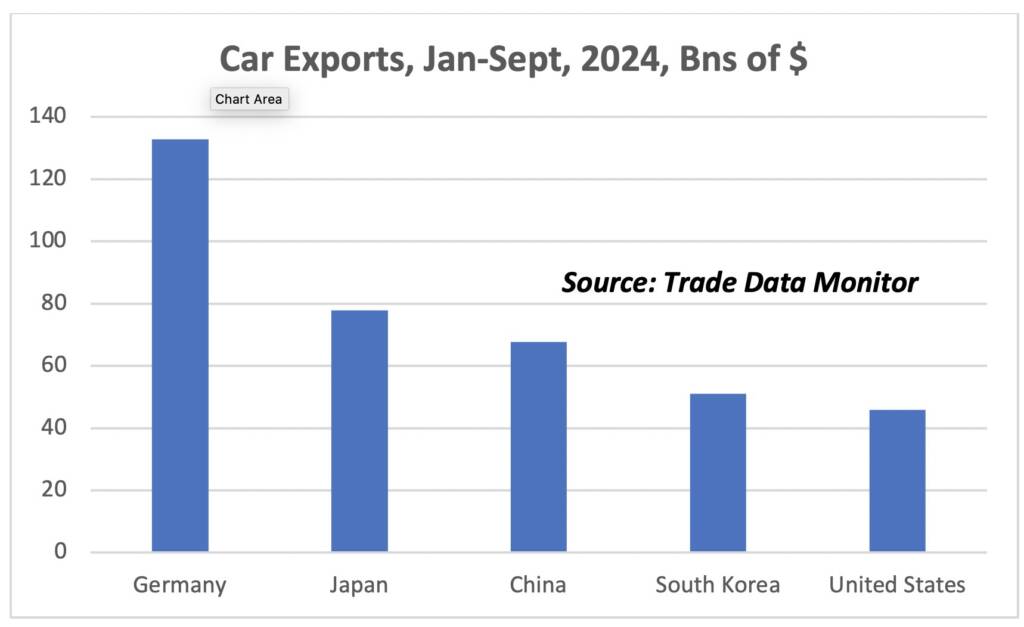

5. German Engineering: Although Germany’s export economy has hit some headwinds, with exports slightly down in 2024, it’s still the globe’s dominant auto exporter. In the first three quarters of 2024, German auto exports increased 18.8% to $132.7 billion. Meanwhile, Japan’s car exports rose 10.2% to $77.8 billion, while China’s shipments nudged up 4.8% to $67.6 billion. In the electric car sector, two countries by far dominate global trade: Germany, with $29.1 billion, down 4.7% year-on-year, shipped out in the first nine months of 2024, and China, with $25.4 billion, up. 1.4%. That’s followed by South Korea, Mexico, Japan, and the U.S.

6. Chips Ahoy: There is less merchandise trade than there used to be, partly because there’s more service and digital trade. But you can’t have digital or service trade unless you have silicon chips. And chips trade is now the key strategic vector. The word’s top chip exporter is Taiwan, and China’s top supplier electronics and electrical parts such as chips is Taiwan, followed by South Korea, China, Japan, Vietnam and Malaysia. In the first 10 months of 2024, China imported $157.7 billion worth of electronics and parts from Taiwan, up 11.1% from the same period in 2023. The position of Taiwan as the center of global high-tech trade complicates its relationship with Beijing.

7. Russia’s meltdown: After the 2022 invasion, Russia cut off its trade statistics, but the TDM database allows us to reverse-engineer Russia trade statistics. And they show an economy that is struggling. In the first nine month of 2024, Russia’s imports fell 6.5% to $148.9 billion, according to TDM. Russia’s top suppliers were China, Kazakhstan, Turkey, Germany and India. China’s number one export to Russia was cars, worth $19.3 billion, up 17.7% year-on-year in the first nine months of 2024. In key consumer sectors such as electronics and footwear, Russian imports from China declined. Germany’s top export to Russia was pharmaceuticals, worth $1.8 billion.

8. Africa: The world’s poorest continent has been showing some bright spots. It’s among the fastest-growing regions in imports from China. Total exports from Kenya rose 14.6% to $6.9 billion in the first 10 months of 2024. The country’s top export markets were Uganda, UAE, the U.S., Pakistan and the Netherlands. Ethiopia’s shipped out $3 billion worth of goods, up 8.9% from the year before. Its chief destinations were Saudi Arabia, the Netherlands, U.S., Germany and the UAE.

9. Grain Markets: The world’s food supplies are at risk because of climate change, protectionism, and war. One country to watch will be Ukraine. Despite Russia’s 2022 invasion, it’s been holding steady as one of the world’s top grain exporters. It’s currently ranked 4th, behind only the U.S., Argentina and India. In the first 9 months of 2024, it exported $7.1 billion worth of cereals, up 10.6% over the same period in 2023. Its top markets were Spain, China, Egypt, Turkey and Italy. One country that could pick up the slack if Ukraine falters: Argentina. Its cereals export rose 19.5% to $8.6 billion in the first 9 months of 2024.

10. Energy Devolution: The rise of populist governments around the world is sure to deflate the move toward green energy products. Total imports of solar panels and related parts shrank 13.3% to $135.3 billion in the first 9 months of 2024. China is the world’s number one buyer, importing $19.9 billion, followed closely by the U.S., Germany, the Netherlands, and India.

John W. Miller

Trade Data Monitor supplies governments, corporations, law firms and trade associations around the world with monthly trade statistics for over 120 countries. Visit tradedatamonitor.com for more information.