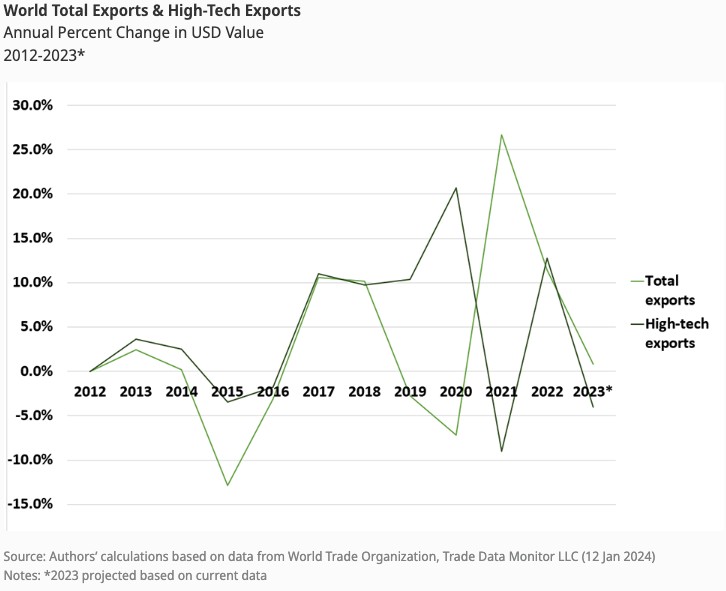

It’s not been an easy time for international trade, as a recent report co-authored by Trade Data Monitor and the World Intellectual Property Organization found.

High-tech exports are set to decline by 4 percent in 2023, according to the TDM/WIPO analysis. Global and high-tech trade have soared and sunk like rollercoasters since 2019. After the strong post-pandemic recovery in 2021 followed by a slowdown in 2022, total merchandise trade is expected to grow at a meagre 0.8 percent in 2023.

Changing global value chains and geopolitical tensions are driving some of the trade slowdown, as well as inflation which is increasing the costs of traded high-tech goods. The development of new sectors, particularly in the manufacturing of renewable energies, batteries and electric vehicles, helps mitigate the high-tech growth slump, however.

The key player, as a consumer and manufacturer, is still China, and Chinese high-tech exports fell 11.4% to USD 728.2 billion in the first 10 months of 2023. The country’s smartphone exports fell by close to 7% to USD 106.8 billion, and sales of its data processing machines dropped 24% to USD 82.8 billion (see Figure 3). Shipments to many of China’s traditional trading partners dropped. Exports to the U.S. fell by 21% to USD 102.7 billion; to the Republic of Korea by 13.4% to USD 33.9 billion, and to the Netherlands by close to 20% to USD 33 billion. Still, despite the decline, China is the leading high-tech exporter by far.

Other Asian economies also experienced high-tech export declines. Exports of the Republic of Korea, for example, declined by 28% to USD 110 billion. Japanese exports fell 10% to USD 76.9 billion. Viet Nam’s export fared better, falling 1.7% to USD 115 billion in the first nine months of 2023.

By contrast, U.S. high-tech exports rose 4.4% to USD 282.5 billion. Shipments to Germany, the Netherlands and Belgium all rose by double digits. U.S. exports of smartphones, routers, board and panels, parts for gas turbines, and computers all increased.

Germany’s high-tech exports rose 6.6% to USD 217.4 billion over the first ten months of 2023. Exports of big airplanes rose 26.8% to USD 19.7 billion, shipments of immunological products rose 9.4% to USD 24.5 billion, and sales of processors and controllers, electric integrated circuits jumped 23.5% to USD 9.6 billion. And France’s high-tech exports increased 2.7% to USD 97.7 billion, thanks to increases in shipments of airplanes (up 16.9% to USD 19.7 billion), electronic integrated circuits (up 16.9% to USD 5.6 billion), and spacecraft, including satellites (up 438.4% to USD 2.1 billion).

Other fast-growing high-tech exporters in Europe include Austria, Hungary and Poland. Austria’s high-tech exports rose 16.9% to USD 22.1. billion in the first 10 months of 2023, thanks to hikes in shipments of anti-serum, up 26.7% to USD 3.8 billion, electrical panels, up 17.3% to USD 983 million, and transistors, up 40.8% to USD 650.1 million.

Hungary’s high-tech exports increased 10.8% to USD 20 billion, on the back of sales of processors, up 11.2% to USD 2.3 billion, routers, up 27% to USD 1.7 billion, and smartphones, up 99.7% to USD 1.1 billion. Polish high-tech shipments increased 7% to USD 29.5 billion thanks to sales of data processing machines, airplane parts and hearing aids.

John W. Miller