For yet another month, China’s merchandise trade exports declined, falling 14.5% year-on-year in July to $281.8 billion. The drop was driven by a weaker economy and an ongoing realignment in global trade. Companies are seeking alternative manufacturing bases to China, to lower costs and temper political risk, and reducing their foreign direct investment that’s underpinned the Chinese economy for the first two decades of this century.

And China’s traditional trading partners are simply buying less because their people have less money to spend. Exports to the U.S. fell 22.7% to $42.3 billion, shipments to Europe fell 20.7% to $42.4 billion, and sales to ASEAN countries dropped 19.2% to $41.8 billion. The weaker demand for goods, as consumer run out of stimulus money and spend more on rent and food, has punctured manufacturing throughout Asian factories, according to surveys of purchasers.

That’s why the UN said in a June report that “the outlook for global trade in/ the second half of 2023 is pessimistic”, a sobering outlook for trade-dependent countries in Asia.

But China is such a big economy – the second largest in the world by GDP and the planet’s top exporter — that there are always pockets of growth, or at least, of more moderate decline, that offer a more nuanced understanding of the global economy.

The bad news has prompted economists to suggest that Beijing implement stimulus measures such as bonds to pay for spending on roads and other infrastructure, which would boost imports of iron ore and other industrial commodities.

To be sure, there are other parts of China’s industry that aren’t faring as bad as the top-line numbers, notably in technology.

Exports of mobile phones increased 2.2% to $9.2 billion. That’s 63.4 million phones. Exports of household appliances dropped only 2.6% to $7.4 billion. And, of course, its automotive sector keeps motoring on. Exports of motor vehicles leapt 83.5% to $8.8 billion. China this year replaced Japan as the world’s top exporter of automobiles.

Exports of ships increased 82.4% to $2.4 billion, but by quantity increased only 3.9% to 456 ships.

The increase in prices for high-priced yachts are an exception. China’s trade data points to a softening of prices in essential commodities, of which it imports massive quantities.

Imports of soybeans, for example, increased 23.4% by quantity to 9.7 million tons, but fell 4.7% by value to $5.5 billion. Because of declining prices, imports of agricultural products fell 10.3% to $18.7 billion, part of some economists’ prediction that the global economy is facing deflation.

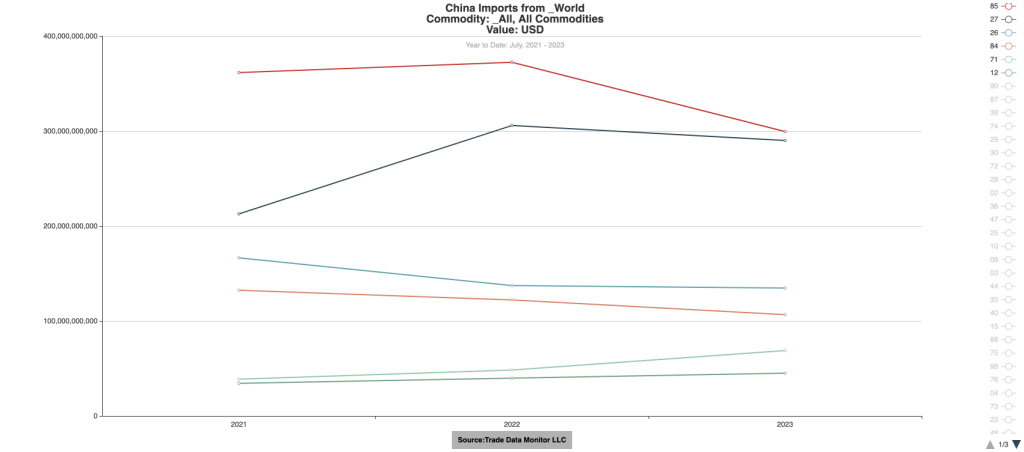

Overall, Chinese imports fell 12.4% to $201.2 billion. Imports from the U.S. dropped 11.2% to $12 billion. Shipments from Europe dropped 2.9% to $23.3 billion. And imports from ASEAN countries fell 10.8% to $30 billion. Imports from India declined 9.5% to $1.4 billion. Even imports from Russia fell, down 8.4% to $9.2 billion.

But China still has sectors of robust internal growth. It needs energy sources to power all the electric cars it’s building, and in July, it again massively increased coal imports, boosting them 67.2% to 39.3 million tons.

One of the biggest changes in the global economy revealed by Chinese trade data is the country’s increasing role in oil transformation.

China hiked imports of petroleum 17.1% to $43.7 million tons, thanks in part to it trading relationship with Russia. It got a bargain for the oil it bought, as imports by price shrank 21% to $23.9 billion.

And China has been transforming some of that oil and shipping it out.

Exports of petroleum products increased 55.8% by quantity to 5.3 million tons, and 5.6% by value to $3.7 billion. During the first seven months of 2023, China increased these exports 46.2% to 36.6 million tons.