The strategic geopolitical battle over semiconductors, the key ingredient in computers and phones, is ramping up, as the U.S., China and other countries boost investments in domestic production, protect their internal markets and aggressively monitor rivals’ capacities.

As the U.S. and China disengage with each other’s most strategic supply chains, other countries, such as Germany and Thailand, are picking up the slack and gaining market share in global trade. The European Union in particular is poised to benefit the most from the current battle over this crucial 21st century resource, while the U.S. is importing more and exporting less. Here are top 10 crucial trade trends to watch in semiconductors:

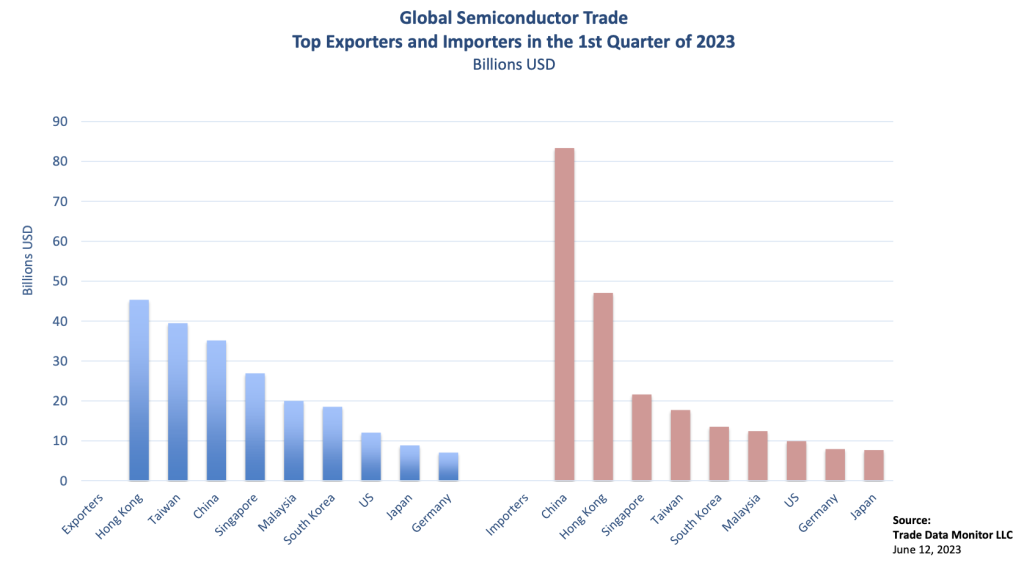

- In the first quarter of 2023, China was the world’s top exporter of semiconductors, shipping out $49.4 billion, down 9.7% from the same period in 2022, followed by Taiwan, Singapore, Malaysia and South Korea.

- The U.S. was only sixth in global export rankings, selling $12.9 billion worth, down 14.1%. If U.S. companies do take advantage of the Inflation Reduction Act, which includes $39 billion for domestic manufacturing, and boost production, it will likely be for domestic markets.

- Overall, as countries become more protectionist, there’s been a retrenchment from global trade. Five of the top six exporters in the world reported declines in exports.

- As a bloc, the European Union was China’s top export market for semiconductors, buying $7.8 billion, up 36% from the same period in 2022. The next biggest importers from China were South Korea, Taiwan, Netherlands, Vietnam, Malaysia, India, Singapore, Brazil and Japan. Meanwhile, the U.S., in ninth place, bought $842.4 million worth. That was up 31.6%, a less meaningful increase because of the smaller amount.

- U.S. semiconductor exports fell 14.1% to $12.9 billion in the first quarter. Its top customer was Mexico, which bought $3.4 billion, 0.7% higher than in 2022. Shipments to China, its second biggest buyer, fell 43.4% to $1.49 billion.

- U.S. exports to the EU increased 6.6% to $1.46 billion. It’s the EU that is poised to benefit the most from the current shakeup in global trade. The third biggest importer from the U.S. is Taiwan, followed by South Korea and the Philippines.

- German exports of semiconductors increased 14.9% to $7.9 billion. Another new upstart player is Thailand, which hiked exports 16.2% in the first quarter.

- China is also the world’s number one importer of semiconductors, buying $85.1 billion worth in the first quarter. However, that number fell 26.2% compared to the same period in 2022.

- The U.S. was one of the only major economies that increased imports of semiconductors in the first quarter of 2023. It imported $15.4 billion worth, up 13.1% from the same period in 2022.

- The U.S.’s top supplier of semiconductors was Malaysia. It imported $3.3 billion worth, down 32.3% from the same period in 2022. The next biggest exporter to the U.S. was Taiwan, which shipped $2.2 billion, up 8.1%, in the first quarter of 2022. The biggest increases came from Vietnam, up 62.7% to $1.7 billion, and Thailand, up 91% to $1.5 billion.