U.S. and European Union policymakers have labored to cut inflation after lathering stimulus on their economies to survive the Covid-19 pandemic.

The resulting higher interest rates are denting consumer demand, which is bad news for Chinese manufacturers who’ve been hoping that consumers from Prague to Portland can lift them out of their doldrums.

Total exports from China fell 6.2% year-on-year in September to $299.1 billion from $319 billion.

Key categories of consumer goods suffered the most. Exports of footwear, for example, dropped 16.1% to $3.9 billion. Shipments of toys declined 13.1% to $4.4 billion. Exports of mobile phones dropped 7.1% to $16 billion. Overall, exports of high-tech products fell 7.4% to $81.5 billion. There were also drops in agro-industrial sectors. Exports of fertilizers, for example, dropped 23.6% year-on-year to $1.1 billion.

One exception: Household appliances. Exports of blenders, coffee makers and other appliances rose 14.1% to $8.2 billion. And Chinese automotive exports, mostly electric vehicles, continued to thrive. Exports of cars and trucks rose 45.4% to $9.2 billion. Across the world, demand for goods favored by middle and upper class consumers has held steady.

Lu Daliang, a government spokesman, said the uncertain recovery from Covid-19 was to blame for China’s export weakness. And it’s true that central banks in Frankfurt and Washington cutting interest rates to tamp down inflation has led to consumers closing up their wallets. But geopolitical uncertainty and rising protectionism are also hurting global trade.

And that’s expected to continue. “The lagged impact of higher interest rates is likely to dampen consumer spending in major export markets over the next few quarters,” Zichun Huang of Capital Economics wrote in a note.

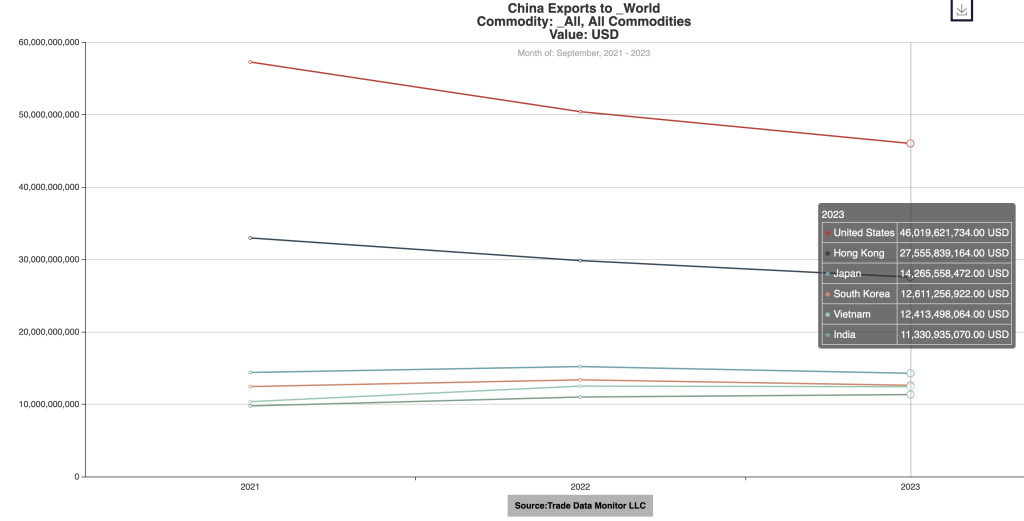

Chinese exports to the U.S. decreased 8.7% to $46 billion from $50.4 billion, and shipments to the EU fell 11.1% to $41.5 billion from $46.7 billion. Exports to ASEAN countries dropped 13.9% to $44 billion from $51.1 billion, and those to Japan declined 6.2% to $14.3 billion from $15.2 billion.

The demand weakness was less pronounced in the Global South. Exports to Latin America fell only 3.2%, to $22.2 billion from $23 billion, and shipments to Africa fell 1.4% to $14.4 billion from $14.6 billion.

The demand weakness has contributed to China’s domestic economy weakening. Total imports fell 6.3% year-on-year to $221.4 billion from $236.3 billion.

Imports from the U.S. fell 11.4% to $12.8 billion from $14.5 billion, and deliveries from ASEAN countries declined 7% to $35.3. billion from $38 billion. Imports from Korea dropped 14.2% to $15.4 billion from $17.9 billion.

One interesting exception: Imports from the EU actually increased, 1.8% year-on-year to $23.9 billion from $23.5 billion. One trend we alluded to above is the rise of a new middle-upper class consumer economy hungry for electric cars, French wines, Italian shoes and luxury goods, all products made in Europe that appeal to wealthy Chinese buyers.

Overall in China, however, prices have weakened, and most people are struggle to maintain incomes and spend money. Imports of agricultural products fell 11.9% to $18 billion, imports of high-tech products fell 9.7% to $63.5 billion, and imports of cars and trucks fell 8.2% to $4 billion.

China continued to increase imports of fossil fuels as its economy continues to grow and consume more overall. It hiked imports of coal 27.8% to 42.1 million tons. Purchases by dollar were more or less flat as prices declined. Natural gas imports rose 73.3% to 10.1 million tons. China’s imports from Russia, chiefly oil and gas, rose 7.1% to $11.5 billion.