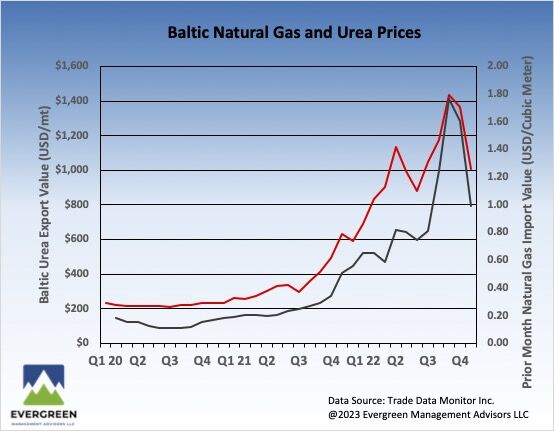

Correlations between urea and natural gas pricing can exist during periods when supply and demand disruptions are not driving prices.

This is logical given that the urea value chain starts with natural gas. Using statistics from Trade Data Monitor, Baltic country (Denmark, Estonia, Finland, Germany, Latvia, Lithuania, Poland, Russia, and Sweden) natural gas import prices and urea export prices show such a correlation.

Currently, dynamics of the European natural gas market has received significant attention in the media with loss of Nord Stream pipelines, startup of Floating Liquid Natural Gas terminals, global competition for LNG imports and regional energy conservation.

Natural gas price scenarios built on these dynamics can be used with urea and natural gas correlations such as this one and form the basis for longer range urea price scenarios.

— Dan Durbin, global petrochemical advisor&consultant