Vietnam, which has become a global trade powerhouse and one of the global economy’s key world trade indicators, posted weak exports in December, suggesting a challenging economic situation in 2023.

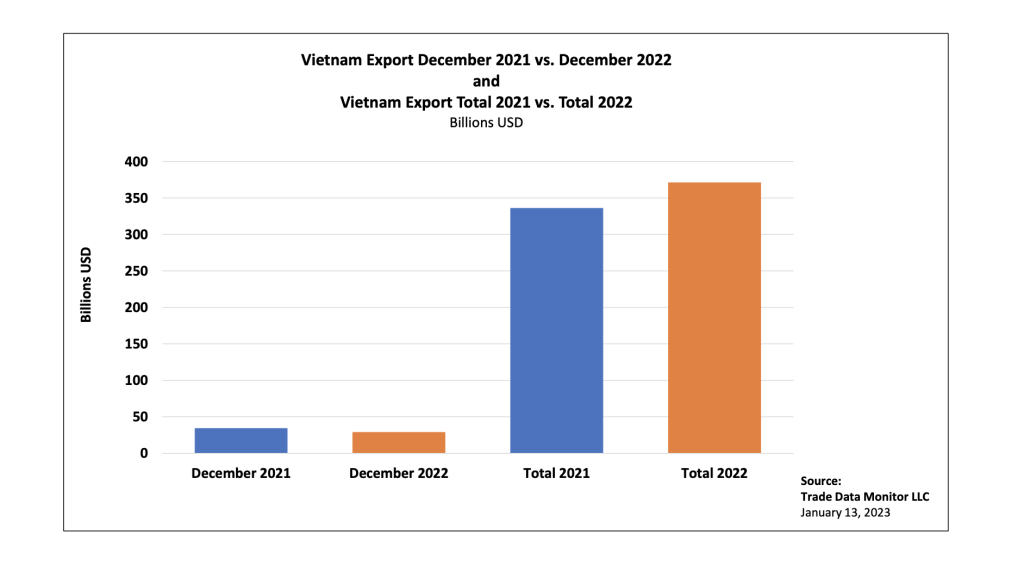

In December, exports fell 15.8% year-on-year to $29 billion. Because Vietnam has become a manufacturing platform for so many companies making high-tech and other consumer goods, this means that economic demand in rich markets, especially the U.S. and European Union, is weakening because of inflation and difficulty recovering from Covid. The World Bank this week cut its 2023 global economy growth outlook to 1.7% for 2023 from a previous forecast of 3%.

The long-term trends for Vietnam’s economy remain strong. The nation of 97.4 million is an export-driven economy which has received heavy investment from firms attempting to reduce the political risks of doing business in China. The U.S. during the summer of 2022 applied new export controls on shipments of computer chips to China. Vietnam’s gross domestic product grew 8% in 2022, the fastest rate of growth in decades, and far ahead of 2.6% growth in 2021. The initial target for 2022 had been a bit over 6%. “The economic performance is worth noting amid global economic and political uncertainty and challenges,” said the General Statistics Office in a statement.

For the year, exports increased 10.5% to $371.3 billion, meaning a surplus of $12.4 billion for the year. And there’s every indication that firms are committed to doing business in Vietnam, where wages are low compared to China and which now has over a dozen new trade deals with economic partners. For the year, exports related to foreign direct investment increased 11.6% to $273.6 billion, although they fell 14.6% to $20.9 billion in December.

Trade with Vietnam’s trading partners followed the same pattern as its overall exports, slackening in December after a robust total 2022.

Total 2022 exports to the U.S., its largest trading partner, rose 13.6% to $109.4 billion. However, in the final month of 2022, exports shrank 20.5% to $8.2 billion. Total 2022 exports to the EU increased 16.5% year-on-year to $47.3 billion. In December 2022, exports to the EU fell 18.6% to $3.4 billion. Total 2022 exports to the group of ASEAN countries, with which Vietnam forms a trading bloc, rose 17.8% to $34 billion.

However, total 2022 exports to China increased only 3.2% to $57.7 billion, suggesting that Vietnam might gradually disentangle itself from China’s economic structures. Vietnam’s trade deficit with China increased to a $60.2 billion in 2022 from $54.6 billion a year earlier.

Exports of specific products also followed the same patterns. Exports of textiles and garments in 2022 rose 14.7% to $37.6 billion. In December, they fell 19.7% to $2.9 billion.

Shipments of phone and phone parts fell 44.6% to $3.1 billion in December, as the market weakened. For the year, those exports increased 0.8% to $58 billion. Even rice exports dropped 12.1% in December to 434,611 tons.

Total imports rose 7.8% to $358.9 billion. Imports in December dropped 14% to $27.3 billion.

Vietnam’s top import was computers, electrical products, spare-parts and components thereof. Those fell 21.4% in December to $5.8 billion. For the year, they increased 8.4% to $81.9 billion. Vietnam’s second top import was machines, equipment, tools and instruments. Those fell 10.9% in December to $3.5 billion. For the year, they declined 2.4% to $45.2 billion.

Imports of another top product, phone and phone parts, dropped 37.9% in December to $1.4 billion. For the year, those declined 1.6% to $21 billion.

Imports related to FDI fell 19.1% in December to $17.1 billion. For the year, imports related to FDI increased 6.7% to $233.2 billion.

With Vietnam’s fundamentals looking strong, the country is almost certain to attract new investment and rebound by the end of 2023.