Another monthly release of China trade statistics, another batch of data showing that rich-country consumers have stopped spending money, inflation is nibbling at budgets, businesses are worried about a recession, and everybody’s freaked out about a trade war.

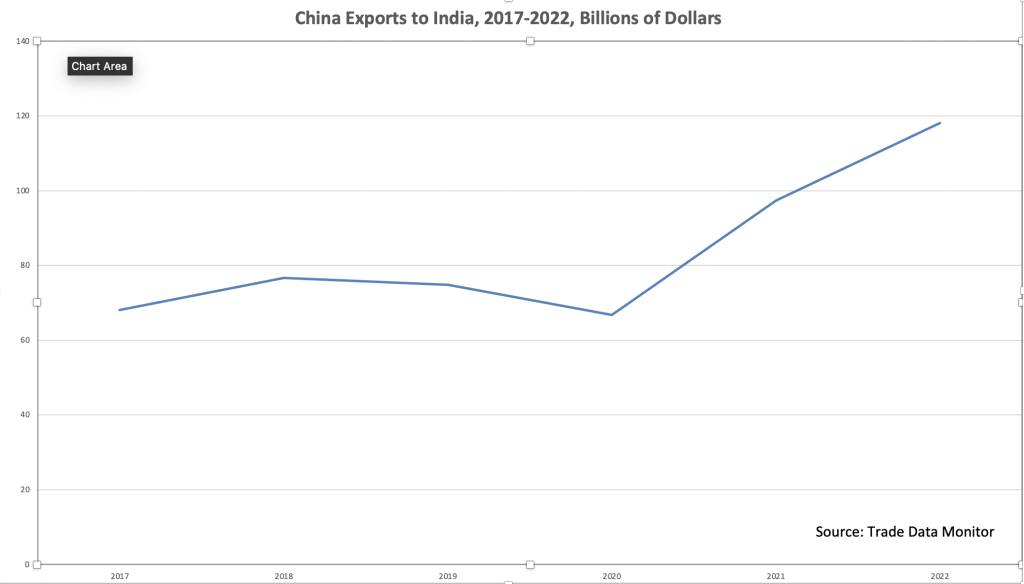

One exception to the gloom: China reported increases in both exports to and imports from India. The numbers are still relatively small, but any jump in trade between the world’s two most populous countries, especially if it’s based on real products and not a random price jump of a commodity like oil or soybeans, is worth noting.

Overall, Chinese exports in August dropped 8.8% year-on-year to $284.9 billion, its fourth straight month of decline, and imports fell 7.3% year-on-year to $216.5 billion.

The big markets that China-based manufactured have relied on this century are all slumping. Shipments to the European Union declined 19.5% to $41.3 billion, exports to the U.S. fell 9.3% to $45 billion, and sales ASEAN countries slumped 11.2% to $42.9 billion.

The Indian Exception

Exports to India increased 1.8% to $10 billion, and imports from India improved 7.1% to $1.6 billion.

The figures released today are preliminary numbers, but we can identify what China and India have been trading with each other based on trade statistics published so far this year.

China’s top import from India has been iron ore, followed by organic chemicals, machinery, diamonds, fish and salt.

In the first seven months of 2023, China increased imports of iron ore from India 77.2% to $2.1 billion, and 134% by quantity to 21.9 billion kilos.

China’s top export to India in the first seven months of 2023 has been the category of electronics. It ramped up exports of electric integrated circuits and micro assemblies 46.7% to $3.2 billion, and shipments of parts for television, radio and radar 22.5% to $1.6 billion.

The increase in trade in electronics with India is significant because China is locked in a battle over semiconductor manufacturing and trade with the U.S. India’s tech sector is one of its bright spots and could underpin growth in trade with the rest of the world.

Another highlight of China’s August trade statistics was the United Kingdom. China increased imports from the UK 7.4% to $1.9 billion.

The Demand Slump Continues

On the export side, China-based manufacturers are still struggling to find markets to unload their products. Exports of high-tech products fell 12.8% to $66.8 billion, shipments of mobile phones dropped 20.6% to $7.2 billion.

One exception, which reflects luxury goods makers’ commitment to China: Exports of suitcases, handbags and similar containers increased 15.6% by quantity to 298,655 tons.

The burgeoning automobile industry continues to thrive in China. Exports of motor vehicles increased 35.3% to $8.2 billion. And exports of ships, another luxury manufacturing sector, rose 41% to $2.5 billion.

China continues to purchase oil and gas from Russia and develop its refinery capacity. Exports of petroleum products increased 23.4% to 5.6 million tons.

Russia Trade Approaches Saturation

On the import side, purchases fell across the board. Imports from the EU fell 5.5% to $24.6 billion, imports from the U.S. fell 7.5% to $12 billion, and imports from ASEAN countries fell 6% to $32.4 billion. Imports of agricultural products decreased 7.8% to $18.7 billion. Imports of fertilizers fell 45.8% to $320 million.

However, China is still increasing imports of commodities it needs to power its new electric car manufacturing sector, especially coal. Imports of coal and lignite rose 50.8% by quantity to 44.3 million tons.

Another important point to note from China’s release of August data: Trade with Russia appears to be approaching saturation. Exports increased 17.4% to $9.3 billion and imports rose only 1.3% to $11.5 billion.