Kenya and Ethiopia’s growing garment exports signal a new phase of development in East Africa and underscore how China-backed investments in infrastructure are helping to reshape economies.

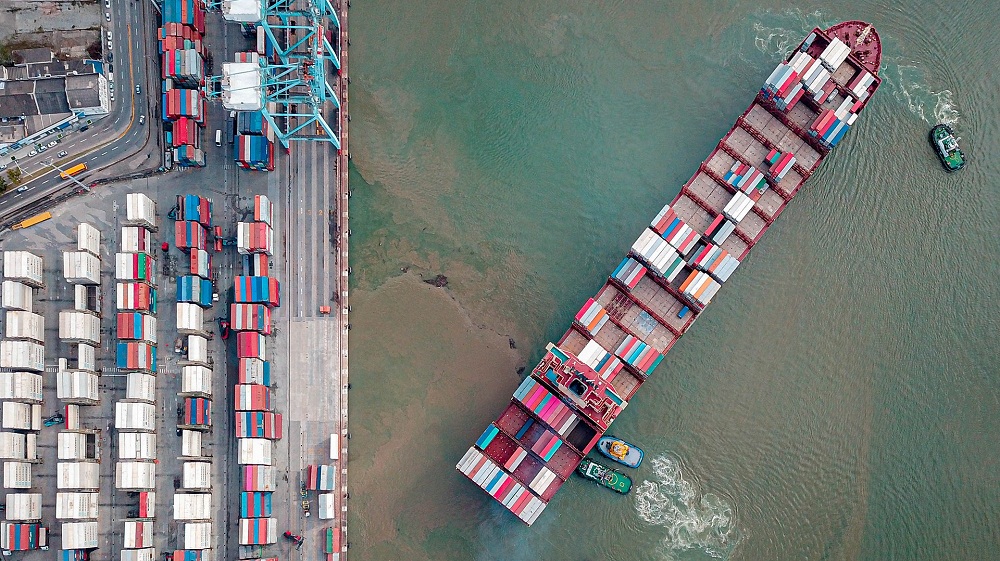

For decades, Kenya and Ethiopia’s main shipments to rich markets in Europe and the U.S. have been niche agricultural products such as coffee, tea, sesame seeds, and fresh cut flowers. Those are still mainstays. Now manufactured goods, especially clothing, are also making their way on container ships to Rotterdam and Los Angeles.

Kenyan clothing exports increased 6% to USD 102.9 million in the first four months of 2019 compared to 2018, according to Trade Data Monitor. Almost 95% of those shipments went to the U.S. In Ethiopia, exports rose 79% in the first six months of 2019, to USD 71.9 million. Around 70% went to the U.S., followed by Germany, Italy and Canada. Big Western clothes-making corporations, including Puma, Gap, Wal-Mart, JC Penney and H&M are sourcing in the two countries. East Africa’s garment exports could be worth over USD 3 billion a year by 2025, say analysts.

The evolution is part of what trade experts say is a vital step in economic development. “The first export sector to take off is always garments”, says Don Brasher, president of Trade Data Monitor and a trade analyst since the 1980s. “That’s what happened in China in the 1980s, Bangladesh in the 1990s and Vietnam in this century. Now wages have risen in those places, making Africa more competitive”.

As companies set up shop, their network makes it easier for other companies to build plants. Apparel companies, for example, draw firms that make zippers, boxes, bags and belts. Wages rise, along with education levels, business confidence and investment in other areas of manufacturing. Other industries follow, such as shoes, watches, electronics.

One crucial asset for exporting manufactured goods is good transportation — ports, roads and rail lines. It’s more complicated and expensive to make and ship factory goods than agricultural products.

East Africa has benefited from Beijing’s attempt this decade to win influence on the continent by helping to fund projects, as part of its Belt and Road Initiative, aiming to cement China’s status as the world’s dominant trading power, by backing transport and infrastructure projects in 68 countries, home to 4.4 billion people and USD 21 trillion in GDP.

These ventures include new fibre-optic cables in Somalia and Ethiopia, and in Kenya a new rail line between the capital Nairobi and the port city of Mombasa. The Aviation Industry Corporation of China has opted to set up its African headquarters in Nairobi.

One part of the BRI strategy is consolidating a trading empire that revolves around Beijing and doesn’t depend on the US. America, however, is still the world’s top market for garments, and its consumers no longer have many domestic options: since the 1980s almost all US production has been offshored. Overall US garment imports in 2018 totalled USD 83.8 billion with the top suppliers all in Asia: China, Vietnam, Bangladesh, Indonesia and India.

To be sure, East African exports are small compared to Asia, and there are obstacles to further growth. In Kenya, real estate and power costs are relatively high. Ethiopia has cheap electricity thanks to hydroelectric dams, but is landlocked, increasing logistical costs. In both places, inefficiency and bureaucratic red tape are a brake on growth.

Trade deals have also helped increase exports. In 2015, the US extended the African Growth and Opportunity Act, a trade deal implemented in 2000, to 2025. Kenya and Ethiopia are two of the 40-some countries receiving preferential treatment for garments under the agreement. In Kenya, firms received a 10-year tax break to invest in Kenya’s so-called Export Processing Zones.

John W. Miller is an award-winning journalist and filmmaker who covered trade, mining and global economics as a foreign correspondent for the Wall Street Journal.

Trade Data Monitor ([email protected]) is a Geneva and Charleston, SC based supplier of import and export statistics from 111 countries.