The steep drop in Vietnam’s exports and imports during the first quarter of 2023 points to vulnerabilities in the country of around 100 million’s economy, as well as slumping factory orders and business confidence around the world.

Vietnam’s quarterly exports fell 11.8% year-on-year to $79.3 billion in the first three months of 2023. Trade makes up a significant part of Vietnam’s economy, and its weakening contributed to Vietnam’s gross domestic product growing only 3.3% in the first quarter, below analyst expectations. For the year, Vietnam’s GDP is now forecast at around 4%, only half what it was last year.

Shipments declined in most major categories. Exports of mobile phones, one of the country’s biggest industries, fell 12.2% to $13.4 billion. Exports of fishery products, declined 27.3% to $1.8 billion. Exports of wood and wooden products fell 30% to $2.8 billion. Exports of furniture dropped 32.2% to $564.1 million. Footwear exports declined 18.3% to $4.3 billion.

There’s been a resurgence in Covid cases in Vietnam this year, but the real challenge for its export base is the global economy. The decline of outbound freight points to weaker consumer demand and consequent nervousness from businesses. As Oxford Economics put it in a note, “global demand continues to weaken through the year.” The Oxford note also pointed to domestic factors at play: “The real estate sector is also facing severe domestic headwinds” from a “credit crunch and an ongoing anti-corruption campaign.”

The World Trade Organization now forecasts global trade to increase 1.7% in 2023, down from 2.7% in 2022, because it’s “weighed down by the effects of the war in Ukraine, stubbornly high inflation, tighter monetary policy and financial market uncertainty.”

To be sure, there were exceptions in Vietnam’s quarterly trade statistics. Shipments of toys increased 6.6% to $868.6 million. One of the only commodity products to perform well was petroleum products, which increased 11% to $488.3 million.

And Vietnam is expected to maintain its status as a prime destination for manufacturers like Apple, LG and Samsung seeking to diversify their production away from China, although it’s nearly impossible to make anything without a few parts made in China. Wages are still low compared to China and the U.S., and Vietnam’s workers are younger. It has 15 trade agreements and an ideal geographic location. Foreign direct investment increased 13.9% in 2022, according to the Vietnamese government.

And exports to almost all major trade partners declined. Exports to the U.S., its main market, dropped 20.9% to $20.7 billion. U.S. consumer demand has been sputtering since the end of Covid stimulus payments and because of inflation, and Vietnamese exporters have been trying to diversify to compensate.

Exports to China fell 11% to $11.9 billion. One promising exception: Exports to the Netherlands increased 3.1% to $2.4 billion.

Meanwhile, Vietnam’s imports, many of which are part of supply chains that then turn into exports, fell 15.4% to $74.5 billion. Imports of plastics fell 31.1% to $2.3 billion. Purchases of iron and steel dropped 27.9% to $2.3 billion. Imports of fertilizers declined 46.2% to $237.5 million. Imports from the U.S. fell 12.1% to $3 billion. Shipments from China fell 14.4% to $23.6 billion.

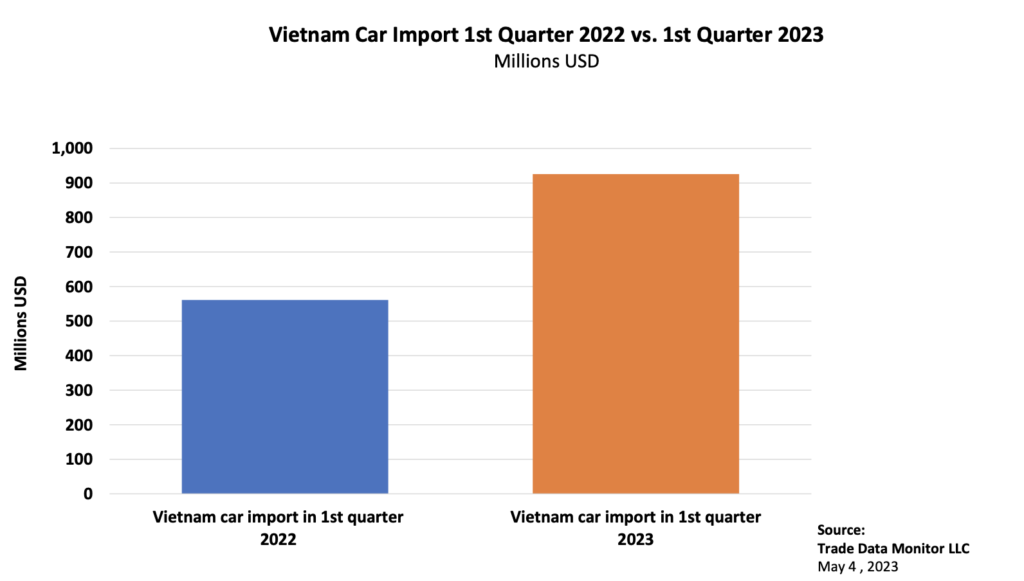

At the same time, there is evidence that Vietnam’s middle class is booming. Imports of automobiles rose 64.8% to $925.5 million. Overall, automobile production increased 14.9% in 2022, according to the Vietnamese government. And Vietnam hiked imports of crude oil 46.4% to $1.7 billion. However, the prosperity still has room to spread. Vietnam’s per capita GDP was $3,400 in 2021, less than a third the level of China’s.