The global economy is sputtering, chipping away at China’s mighty export machine and prompting Beijing to build a stronger trading relationship with Moscow even as Russia faces trade sanctions with the U.S. and European Union.

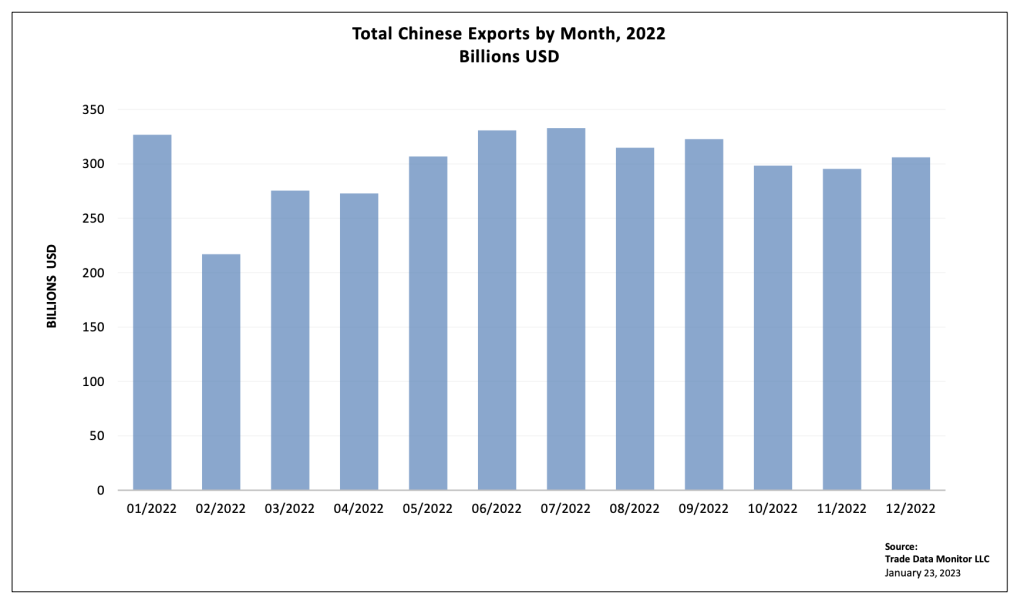

Chinese exports in December declined 9.9% year-on-year to $306 billion. “China’s foreign trade and exports showed strong resilience in the face of many difficulties and challenges,” customs spokesperson Lu Daliang told reporters. The World Bank in January cut its forecast for the global economy to 1.7% growth from a previous forecast of 3%.

To be sure, China is set to rebound as the country opens up against after lockdowns to fight the Covid-19 pandemic. The economy will get going again, although China faces the prospect of over a million deaths as unvaccinated people go to work.

China has also looked to Russia to increase trade. It’s been buying gas and oil that Russia can no longer sell to Europe. However, China’s trade with Russia hit a record $190 billion in 2022. In December, Chinese imports from Russia, mostly oil and gas, rose 7.7% over a year earlier to $9 billion.

The decline in December exports was driven by weakness in consumer demand in the U.S. and Europe. Exports of high-tech products dropped 25.7% in December to $78.1 billion. For the year, high-tech exports dropped 2.8% to $951.3 billion. Exports of mobile phones dropped 29.2% to $13.5 billion. For the year, they fell 2.5% to $142.7 billion.

The decline can be attributed to “weakening global demand for Chinese goods, as well as some disruption to logistics networks and goods supply due to labor shortages amid the reopening wave of infections,” said Capital Economics analysts in a Friday research note.

However, the manufacturing supply chain that supplies goods for rich people is faring just fine. Motor vehicle exports rose 90.8% year-on-year in December to $5.9 billion. Shipments of footwear increased 2.5% year-on-year in December to $5.4 billion. Exports of textiles, however, declined 22.9% to $11 billion.

In December, exports to the U.S. dropped 19.4% year-on-year to $45.4 billion. Imports of U.S. goods declined 7.1% to $15.9 billion. That produced a $29.5 billion surplus, down 24.8% from a year earlier. For the full year, China’s trade surplus with the U.S., rose 2.2% from 2021 to $404.1 billion.

The trade relationship between Beijing and Washington faces further challenges in 2023 after the Biden administration-imposed export controls on computer chips. High-tech firms have been looking to countries like Vietnam and Mexico to diversify their supply chains, and high-tech trade with the U.S. has fallen.

Exports to the EU fell 17.4% to $43.6 billion. Imports of European goods fell 13.5% to $24 billion. China’s trade surplus with Europe fell 21.7% to $19.6 billion. “Downward pressure on the world economy is increasing,” a senior Chinese official told reporters.

Other big economies are now looking to Chinese consumers to increase their purchases. China’s reliance on exports is historically massive, and its hefty trade surpluses with the rest of the world don’t appear sustainable. China’s central bank has struggled to control the rise of the yuan.

For all of 2022, exports rose 7% year-on-year to $3.59 trillion, less than 2021′s 29.7 % rise from the depths of the Covid-19 pandemic. Imports increased 1.1% to 2.7 trillion, below previous year’s 30% uptick. The country’s trade surplus expanded by 30.7% to $877.6 billion, setting a new record.

And although China is the world’s number two economy, after the U.S., it’s still the greatest trading power the world has ever seen. China’s total trade, imports plus exports, hit $6.3 trillion in 2022, up 4.4% from 2021, and an all-time record.