Concerns over climate and dietary desires have diluted milk production and consumption in Europe, but production is growing in Asia, now the world’s top milk producer, and overall global trade in dairy products is surging, according to an analysis by Trade Data Monitor.

Total world dairy exports increased to $81.7 billion over the first nine months of 2022, up 11% from $73.6 billion over the same time period in 2021, and up from $65.4 billion in 2020. Cheese makes up a bit over a third of that trade, and milk and cream a bit under a third. The rest is butter, eggs, whey, derived products such as yoghurt, and honey.

Dairy is heavy and expensive to ship compared to some other commodities. The global dairy market is worth around $800 billion, and a quarter of that is cheese.

Producers in the U.S., European Union, and the dairy powerhouse of New Zealand, which have mature dairy markets are poised to benefit the most from this expansion in global trade.

Germany has been the world’s top exporter, up 12.3% to $9.8 billion over the first nine months of 2022. Germany’s main export was cheese and curd, up 14.9% to $4.6 billion, followed by milk and cream, up 6% to $2.6 billion.

New Zealand was second, exporting $9.4 billion, up 11.5%, followed by the Netherlands, France, and the U.S. The latter increased its exports 21.7% year-on-year to $5.9 billion. Its top markets were Mexico, the Philippines, Canada, China and South Korea.

“U.S. exports have been rising for the past two decades, and the U.S. dairy industry — from farmers to manufacturers — have been doing the hard work to build and service demand for U.S. dairy for just as long,” Krysta Harden, boss of the U.S. Dairy Export Council, said in a recent statement.

World milk production in 2022 is forecast at around 930 million tons, according to the Food and Agricultural Organization, up 0.6 % from 2021. Europe is producing much less milk, because of climate and dietary concerns, but Asia is producing much more, the FAO says. Europe benefits from generous farm subsidies and an open internal market.

In Europe, which has the world’s most vibrant dairy market, trade flows are changing. The Netherlands, which has been cutting down on farmland for dairy in order to reduce emissions, increased its imports of milk and cream 27.2% to 901,543 tons in the first nine months of 2022. Overall the Netherlands ramped up dairy imports 21.7% to $4.6 billion over that time. The cheese-crazy nation even imported $1.3 billion worth of cheese, up 18.2% year-on-year.

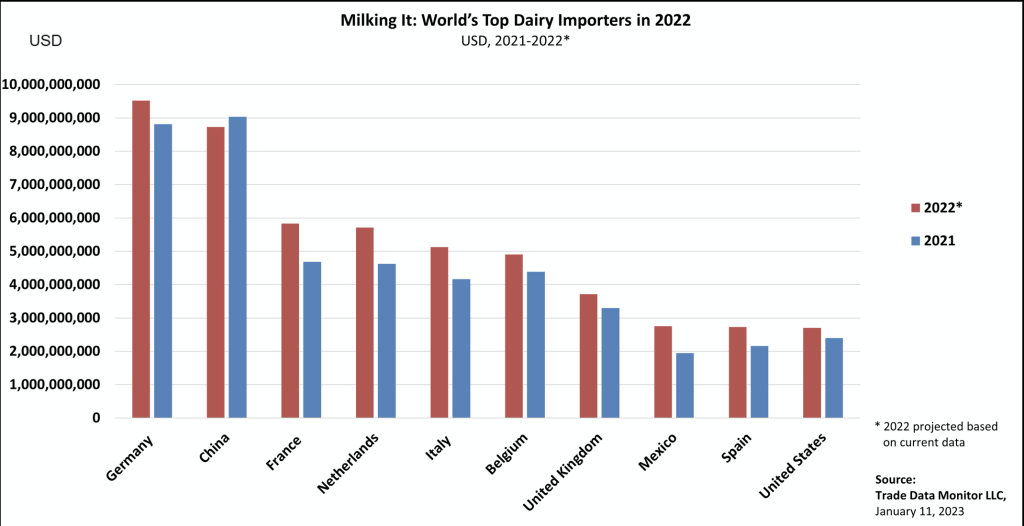

Four of the world’s top five dairy importers are European. Germany is the world’s top buyer, importing $8.4 billion during the first nine months of 2022, up 9.9% year-on-year. China is currently second, buying $7.5 billion worth, down 0.7%, over that time, followed by France, the Netherlands and Italy.

New Zealand’s top market was China, but it’s been losing share there. Dairy exports to China fell 9.4% to $2.9 billion. It’s been gaining elsewhere. Exports to Indonesia rose 78.3% to $632 million. Shipments to Australia rose 12.9% to $432.2 million. Exports to Malaysia increased 26.3% to $387.3 million.

As a bloc, the EU ranks only seventh in the world in dairy imports, behind China, the U.S., Mexico, Saudi Arabia, Indonesia and Japan. The EU imported $1.2 billion, up 19%. Roughly a quarter of that was cheese from Switzerland. It also bought $189.1 million from Ukraine, up 88.9%.